Популярное

Полезные советы

Важно знать!

14 подходящих профессий для специалиста социально-экономического профиля

Приобретаемые навыки

Выпускник направления будет иметь компетенцию для решения следующих важных задач:

подготовка и проведение исследовательских кампаний: социологических, аналитических, консалтинговых;

подготовка...

Читать далее

20 лучших курсов по дистанционному обучению на психолога для начинающих и для повышения квалификации

9-й или 11-й? сколько школьных классов выгоднее заканчивать

10 популярных профессий для выпускников исторического факультета

30 лучших курсов по дизайну с нуля

20+ лучших творческих и развивающих онлайн-курсов для женщин

5-балльная или 10-балльная система оценок в школе

10 оптимальных мест работы для специалиста в электроэнергетике и электротехнике (обзор с уровнем зарплаты)

50 лучших цитат про учителей

6 вузов россии, где можно получить педагогическое образование дистанционно

Рекомендуем

Лучшее

Важно знать!

30 профессий, которые не требуют образования

Пять профессий, которые вы сможете освоить за полгода

В 2020 году пандемия коронавирусной инфекции сильно изменила международный рынок труда. Только в России 12 миллионов человек потеряли работу, а...

Читать далее

20 прибыльных профессий, которые высоко оплачиваются в сша и странах запада

6 бесплатных курсов по педагогике и онлайн-обучению

1 сентября

9 учебных заведений, в которых можно получить высшее сестринское образование заочно

10 лучших школ москвы, если не взяли в хогвартс

10 признаков того, что хороший программист из вас не получится

9 вещей, которые вы должны иметь в виду, прежде чем стать стоматологом

11 классов школы: какое это образование

5 вузов, где можно получить высшее образование онлайн

Обсуждаемое

Важно знать!

1c-разработчик

Должностные обязанности

Рассмотрим, что делает программист 1С на предприятии, в чем заключаются его обязанности. Прежде всего такому специалисту придется не только работать с программой 1С самому, но...

Читать далее

10 олимпиад, где может блеснуть знаниями школьник

10 игр для программистов, которые позволят улучшить свои навыки

7 способов получить дополнительные баллы при поступлении в 2020 году

30 популярных специальностей колледжей москвы 2021

5 ведущих вузов и колледжей россии, в которых можно получить педагогическое образование заочно

10 творческих профессий, связанных с литературой и русским языком

13 бесплатных онлайн-курсов по дизайну интерьера

5 самых наиболее популярных видов психологических тренингов

3 современных метода пересадки волос

Популярное

Актуальное

Важно знать!

7 профессий, связанных с едой: дегустатор, официант, технолог и другие

Испытатель видеоигр

Эта работа связана не только с удовольствием и развлечениями, как многие думают. Она требует от специалиста повышенного внимания, чтобы выискивать в играх ошибки и различные дефекты....

Читать далее

20 best 3d animation software in 2021 [free/paid]

8(914)8923: какой регион и оператор?

15 самых распространенных языков в мире

1 сентября личный кабинет

15 достойных вакансий для тех, кто не любит людей (16 фото)

Сервис менеджер ресторана

Курсы повышения квалификации для воспитателей доу: подборка и отзывы

Программист, экономист, инженер и ещё 7 профессий, где нужна математика

Гостевая книга

Обновления

Аллоплант: чужой саженец вашего здоровья

Аллоплант: чужой саженец вашего здоровья

Технологии лечения

Для регенерации разных тканей создано более девяноста типов аллоплантов. Диспергированная...

Обзор профессии видеомонтажер

Обзор профессии видеомонтажер

Оплата труда

Важные качества

Профессия режиссёра-постановщика предполагает артистизм, образное мышление,...

Как сделать оглавление в дипломной

Как сделать оглавление в дипломной

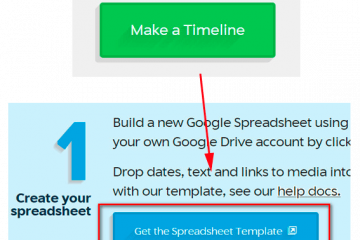

Как сделать оглавление (содержание) в Microsoft Word

Вы удивитесь, но в Word сделать это можно намного...

Рейтинг лучших художественных вузов страны

Рейтинг лучших художественных вузов страны

ArtEZ University of the Arts, Нидерланды

ArtEZ - это художественная академия в списке лучших художественных...

Топ-10 лучших гуманитарных профессий

Топ-10 лучших гуманитарных профессий

Недостатки профильных классов

Что касается минусов подобных программ обучения, то они следующие:

Отсутствие...

Что должна содержать должностная инструкция секретаря: примеры и образцы документов

Что должна содержать должностная инструкция секретаря: примеры и образцы документов

Секретари в сфере образования

Если раньше вы считали эту работу едва ли не самой простой, достаточно...

Направленности программ дополнительного образования детей

Направленности программ дополнительного образования детей

Виды ДПО

Designed by standret/Freepik

Дополнительное профессиональное образование обычно получают...

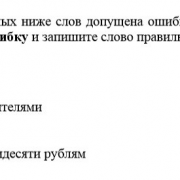

Как выставляется оценка по математике в аттестат 9 класса?

Как выставляется оценка по математике в аттестат 9 класса?

Условия получения красного аттестата в 11 классе 2020 года

Красный аттестат после 11 класса — документ,...

Аграрные вузы россии

Аграрные вузы россии

Список лучших вузов России, рейтинг 2021 года

Зато в регионах аграрные специальности и сельское хозяйство...

Куда пойти учиться после 9 класса в г.мыски в 2021

Куда пойти учиться после 9 класса в г.мыски в 2021

Содержание

Заголовки для www.туэтт.рф

Веб-сервер

Информация о дата-центре

Время загрузки...

Профессия недели: моряк. 11 фактов из жизни мореплавателей

Профессия недели: моряк. 11 фактов из жизни мореплавателей

Татуировка как оберег

Татуировка у моряков с давних времён считалась оберегом и опознавательным знаком....